How to Get the Most Out of Your Health Insurance

In this post, we explore ways to understand your health insurance policy and tips to use it wisely. From staying in-network to appealing coverage denials, learn how to maximize your health benefits.

In this post, we explore ways to understand your health insurance policy and tips to use it wisely. From staying in-network to appealing coverage denials, learn how to maximize your health benefits.

Manage financial stress by understanding your situation, budgeting, setting goals, seeking help, repaying debt, building an emergency fund, and practicing self-care.

Planning for your child's education is a significant parental investment. This guide covers early planning, cost estimation, savings plans, scholarships, child contributions, insurance review, and the value of professional financial planning help.

Want to cut costs without cutting out fun? Our blog post shares practical tips on prioritizing expenses, finding free activities, hosting get-togethers, utilizing discounts, staying active, and more.

What goes on in our minds when we make financial decisions? Our blog post delves into the psychology of spending and saving, uncovering factors like instant gratification, social comparisons, the pain of paying, mental accounting, sunk cost fallacy, and anchoring.

Holidays need not break your bank! Learn how to budget, plan, and make mindful decisions that can keep you financially stable during the festive season while ensuring you and your loved ones have a memorable time.

Considering starting your own business? This article discusses important financial considerations, including personal finance evaluation, understanding startup and operational costs, exploring funding options, and much more to help you prepare.

Personal loans can be a versatile financial tool, but they require careful consideration. Our comprehensive guide helps you understand personal loans, ensuring you make informed decisions.

As a single adult, you bear sole responsibility for your financial security. In our latest post, discover how to navigate the unique financial challenges and opportunities you face.

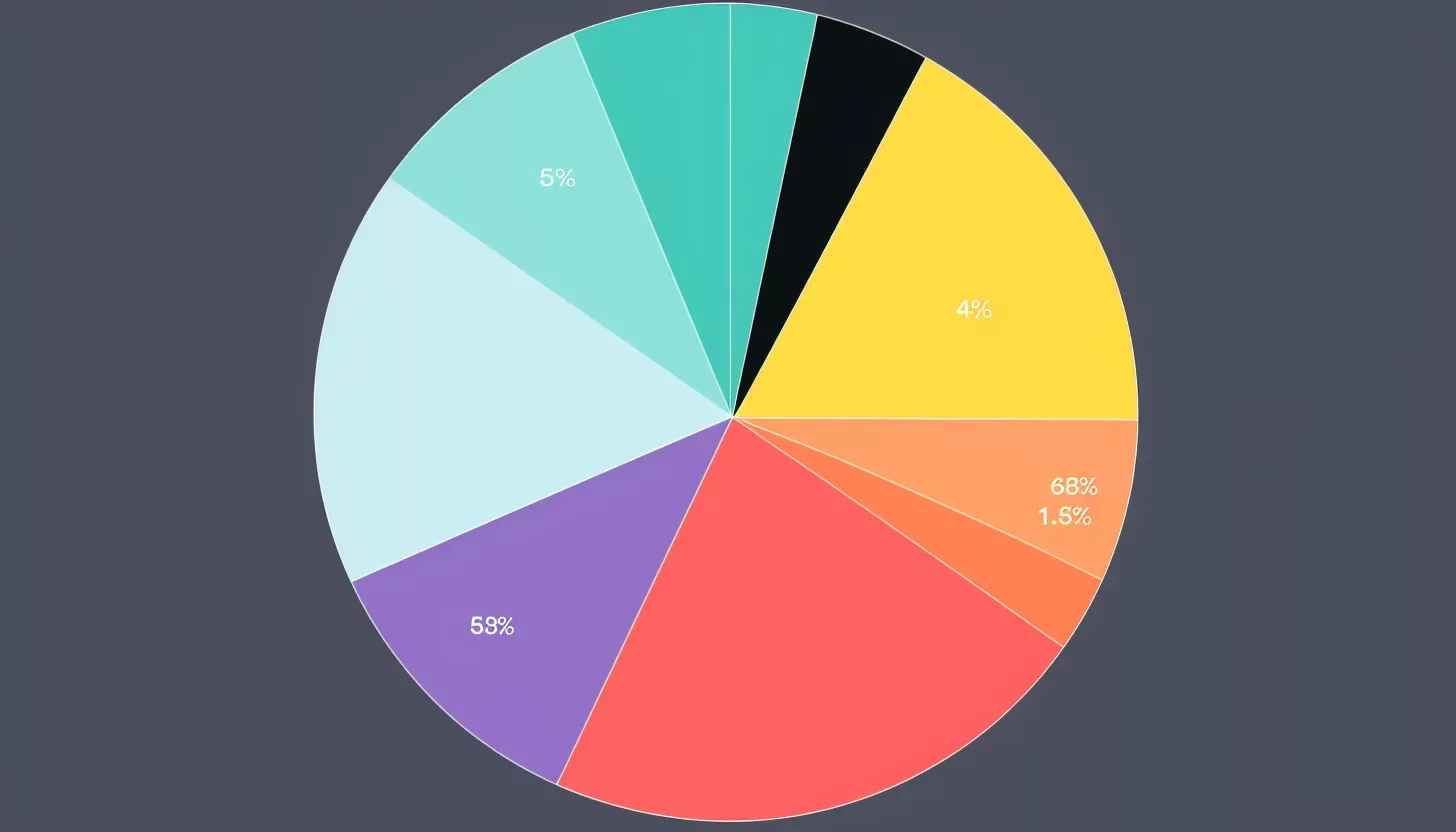

Diversification is a key investment strategy that mitigates risk by spreading investments across various assets. It offers the potential for better returns, helps preserve capital, and reduces portfolio volatility.