The Importance of Diversification in Investing

Diversification is a widely recognized strategy in the world of finance, and for good reason. By spreading investments across a variety of assets, sectors, and geographical locations, diversification aims to reduce risk and potentially achieve more consistent returns over time. In this simple guide, we will explore the importance of diversification in investing, its benefits, and how to implement this strategy effectively. Understanding the concept of diversification can empower investors to make informed decisions and build resilient portfolios.

What is Diversification?: At its core, diversification involves spreading investments across different assets, sectors, and geographical locations. The goal is to reduce the risk associated with investing in a single asset or sector by ensuring that potential losses in one area can be offset by gains in another. By diversifying, investors can avoid the pitfalls of putting all their eggs in one basket and increase their chances of achieving more stable and favorable investment outcomes.

The Benefits of Diversification:

- Risk Reduction: The primary benefit of diversification is risk reduction. Investing all your money in one asset exposes you to significant risk. By spreading your investments, you lower the chances of a single investment negatively impacting your entire portfolio. If one asset underperforms, the positive performance of other assets can help offset potential losses.

- Potential for Better Returns: Diversification offers the potential for better long-term returns. Different assets perform well at different times due to market fluctuations. By diversifying across various assets, sectors, and geographical locations, investors can capture the potential for growth in different areas of the market, enhancing their overall returns.

- Preservation of Capital: Diversification can be particularly beneficial for risk-averse investors who prioritize capital preservation. By including lower-risk assets, such as bonds or cash, in a diversified portfolio, investors can aim to protect their initial investment while still benefiting from potential growth opportunities.

- Portfolio Volatility Reduction: Diversification helps to reduce portfolio volatility. While some assets may experience significant price swings, others may be more stable. By spreading investments across different asset classes and sectors, investors can smooth out the overall volatility of their portfolio, creating a more balanced and predictable investment experience.

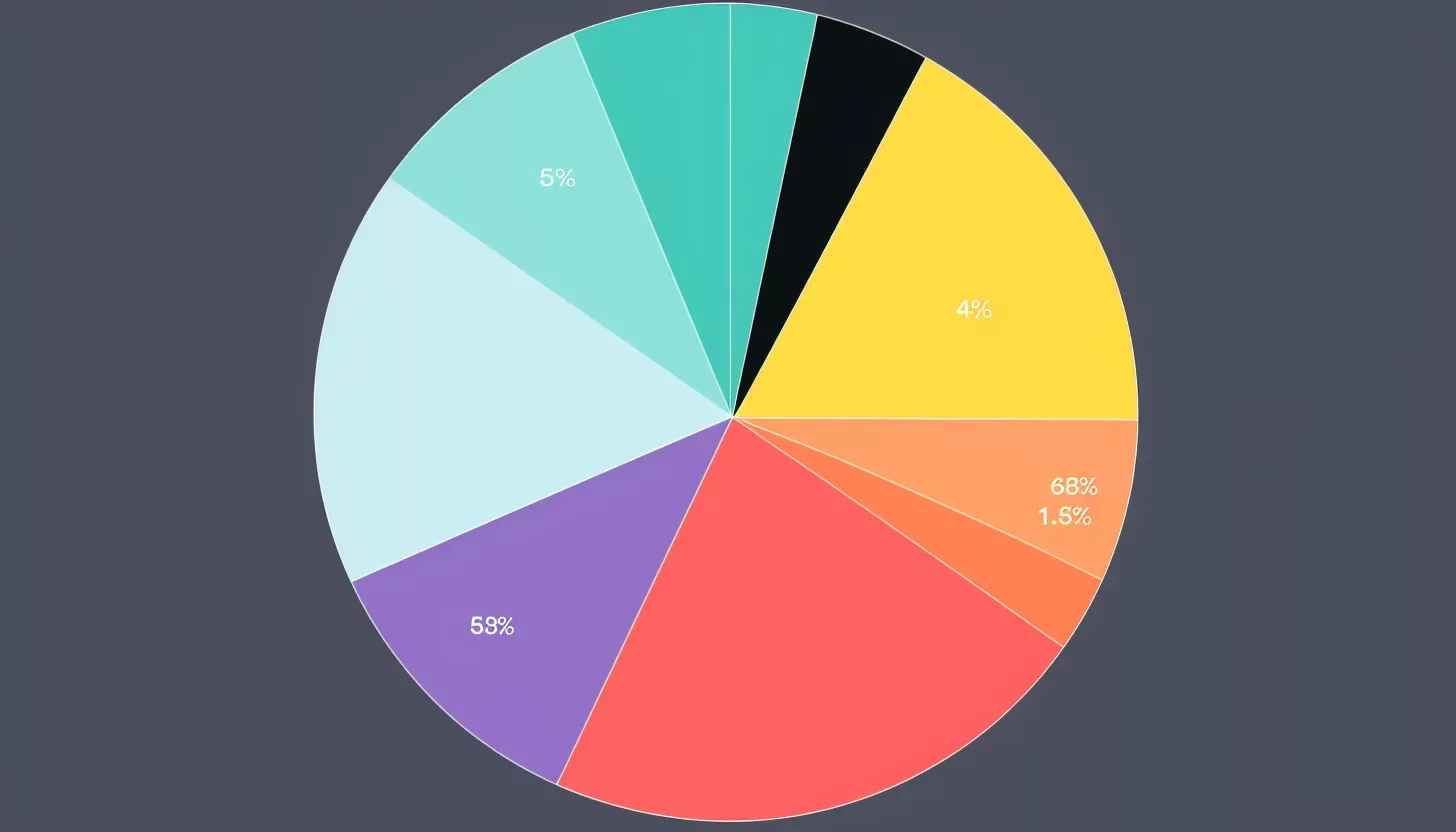

Implementing Diversification: Diversification goes beyond owning different stocks. It involves spreading investments across a range of asset classes, including stocks, bonds, cash, real estate, and alternative investments like commodities or private equity. Additionally, diversification extends to different sectors of the economy and different geographical locations.

Implementing diversification requires careful consideration of individual investment goals, risk tolerance, and investment horizon. Factors such as age, financial objectives, and risk appetite influence the ideal asset allocation and diversification strategy. Some investors may choose to diversify globally to access international markets, while others may focus on specific sectors or asset classes that align with their investment objectives.

Regular portfolio rebalancing is essential to maintain diversification over time. As asset values fluctuate, the original allocation may shift, potentially exposing the portfolio to unintended risks. Rebalancing involves adjusting the asset allocation to bring it back in line with the desired diversification targets.

Conclusion: Diversification is a powerful strategy that can help investors mitigate risk, enhance returns, preserve capital, and reduce portfolio volatility. By understanding the importance of diversification and implementing a well-thought-out diversification plan, investors can build robust portfolios that weather market fluctuations and increase their chances of long-term success. Remember, diversification is not a one-time event but an ongoing process. As financial markets evolve and economic conditions change, it's essential to regularly review and adjust portfolio allocations. By maintaining a diversified portfolio and staying vigilant, investors can position themselves for long-term success while managing risk effectively.

Hi, I'm Arvind Otner, the voice behind Wise Wealth Tips. My mission is to simplify financial ideas, empowering you to make smarter money decisions. Welcome to your journey towards financial literacy...