A Guide to Understanding Personal Loans

Personal loans can be a versatile financial tool, but they require careful consideration. Our comprehensive guide helps you understand personal loans, ensuring you make informed decisions.

Personal loans can be a versatile financial tool, but they require careful consideration. Our comprehensive guide helps you understand personal loans, ensuring you make informed decisions.

As a single adult, you bear sole responsibility for your financial security. In our latest post, discover how to navigate the unique financial challenges and opportunities you face.

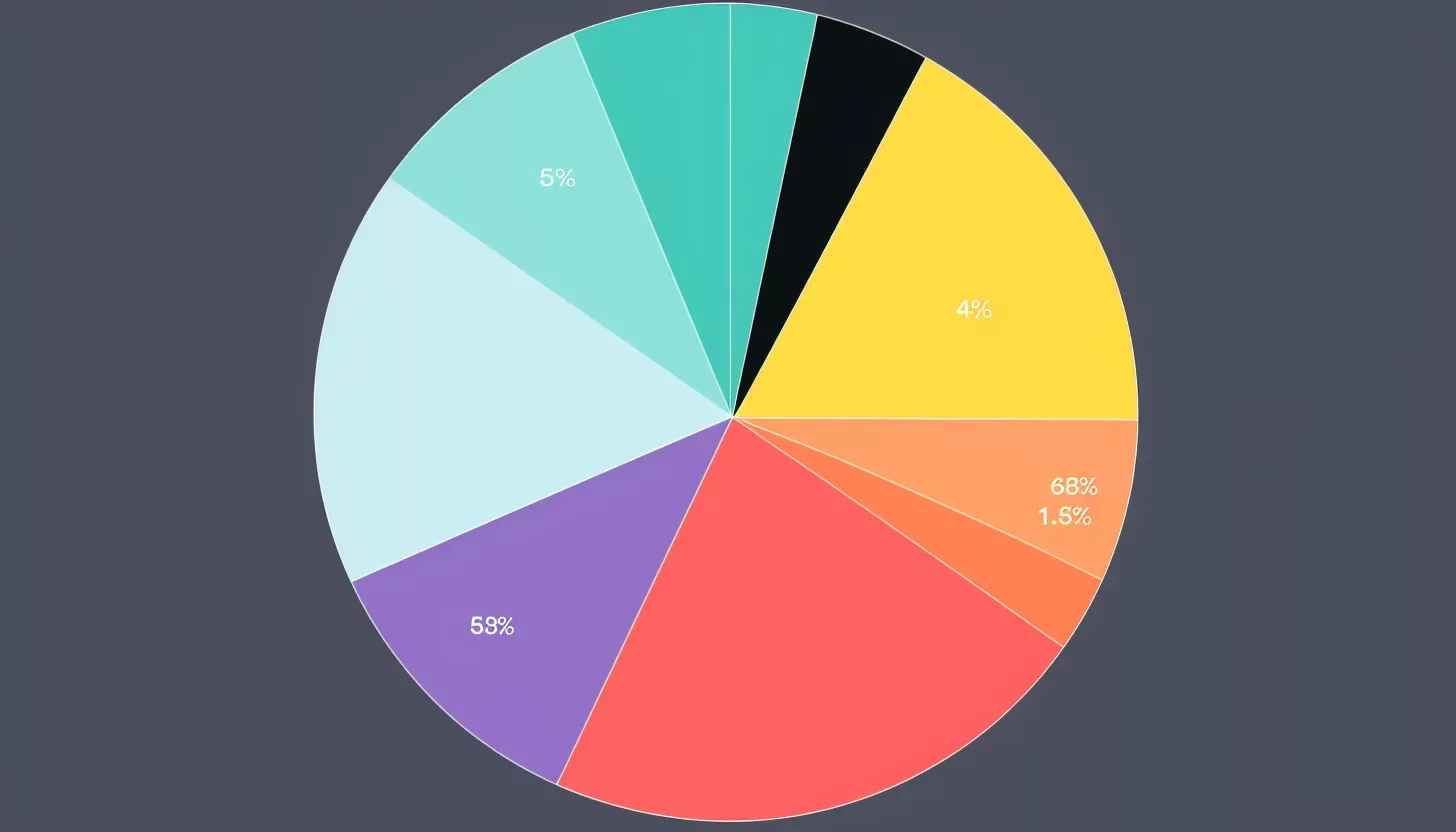

Diversification is a key investment strategy that mitigates risk by spreading investments across various assets. It offers the potential for better returns, helps preserve capital, and reduces portfolio volatility.

Building a solid foundation for homeownership begins with saving for a down payment. This blog post offers practical steps to help you reach that milestone effectively and smoothly. Start your journey to homeownership now.

Owning a car involves more than just the purchase price. From insurance and fuel to maintenance and depreciation, this post unpacks the hidden costs behind the wheel, helping you understand the true cost of car ownership.

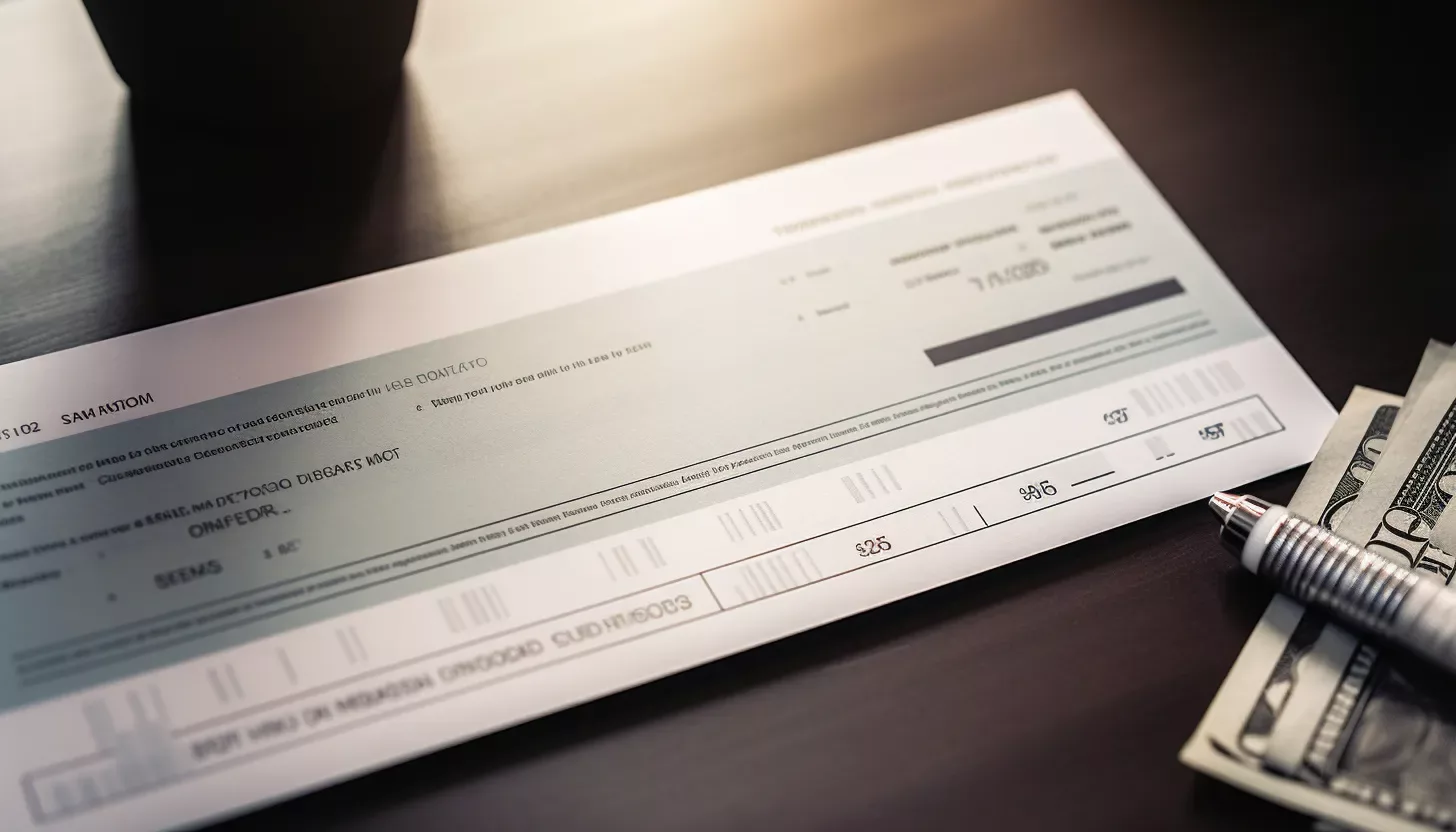

Your paycheck is more than just your take-home pay. This guide demystifies common paycheck deductions, helping you understand where your earnings are going, from taxes and Social Security to health insurance and retirement contributions.

Healthcare costs can significantly impact your financial health. This article explores the financial implications of healthcare expenses and offers strategies to manage them effectively, ensuring a healthier financial future.

This blog post dives into the habits of highly successful savers. Learn how setting clear financial goals, budgeting, automating savings, living below your means, prioritizing debt repayment, investing wisely, and continual learning can boost your savings.

Explore the potential benefits and drawbacks of credit card rewards. From earning while you spend to high-interest rates, this guide will help you navigate the intricacies of reward programs, helping you make informed decisions on your financial journey.

Cut your grocery bill without cutting quality. This post offers practical tips from meal planning and seasonal buying to leveraging discount days and store brands, helping you maintain a healthy diet while staying within your budget.